Arthur Hayes Says Bitcoin Drop Happened Because There’s Less US Dollar Liquidity

Arthur Hayes: Bitcoin’s Drop Is Caused by Falling Dollar Liquidity — Not Because Institutions Lost Interest

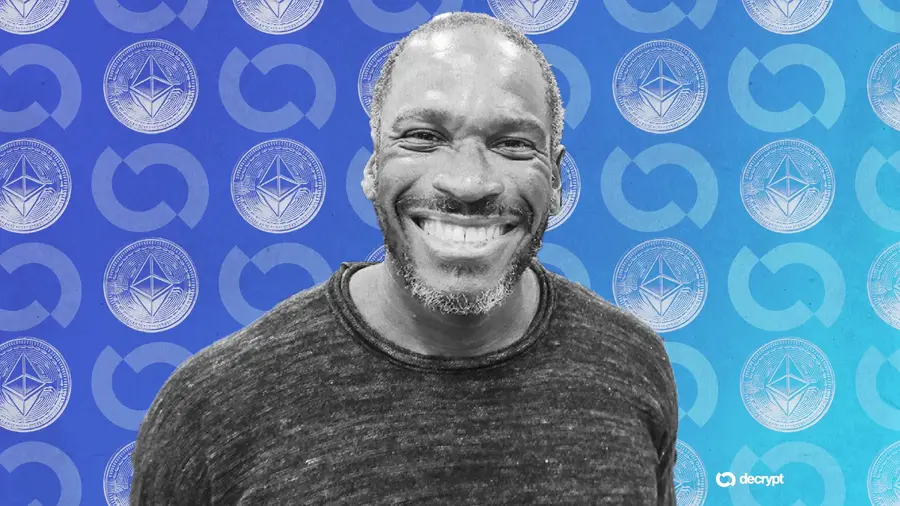

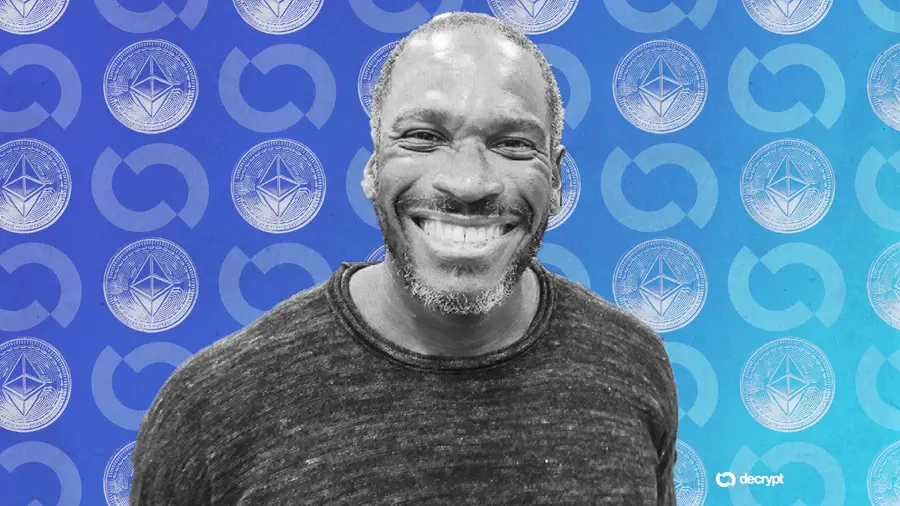

Arthur Hayes, a well-known crypto analyst and former CEO of BitMEX, says that Bitcoin’s recent price drop is mainly caused by reduced U.S. dollar liquidity, not because institutional investors or governments have stopped supporting Bitcoin.

He wrote:

“Bitcoin is the free-market weathervane of global fiat liquidity. It trades based on expectations of future fiat supply.”

On Tuesday, Bitcoin fell below $90,000, reaching a seven-month low, and erased all its 2025 gains. Hayes believes that when Bitcoin drops while the S&P 500 and Nasdaq 100 are near record highs, it signals that a credit crisis may be coming.

Hayes’ Prediction: Bitcoin Could Hit $200K–$250K

Hayes argues that if the stock market drops 10–20% and interest rates stay high around 5%, the U.S. government will likely print more dollars to support the economy.

If that happens, the increase in liquidity could push Bitcoin to $200,000–$250,000 by the end of the year, especially if risk markets crash and the Fed starts aggressive money printing.

Why Did Bitcoin Rise Earlier Even When Liquidity Was Falling?

Hayes notes that Bitcoin continued to rise after April, even though USD liquidity was declining. He believes this was mainly because of:

- Large institutional investments through Bitcoin ETFs, and

- Pro-crypto statements from the Trump administration.

But now, the situation has changed.

Bitcoin ETFs See Record Outflows

Bitcoin ETFs have seen historic outflows recently.

For example, BlackRock’s IBIT ETF saw a record $463 million outflow in a single day on November 14, while globally, crypto funds recorded $2 billion in weekly outflows.

Hayes explains that many large institutions holding IBIT—such as Goldman Sachs and Jane Street—are not actually investing in Bitcoin for long-term gains. Instead, they are using it for a “basis trade.”

What Is a Basis Trade?

In a basis trade, traders:

- Buy a Bitcoin ETF, and

- Short a Bitcoin futures contract,

to profit from the price difference (spread) between the ETF and the futures contract.

So, these institutions aren’t bullish on Bitcoin, they are simply trading the spread.

Hayes explains:

“They are not long Bitcoin. They short CME Bitcoin futures while buying the ETF to earn the spread between the two.”

This strategy is capital-efficient because brokers often allow traders to use the ETF as collateral for their futures short position.

According to JPMorgan, around $400 billion is currently tied up in basis trades across financial markets.

Why This Leads to Bitcoin Selling

As Bitcoin’s price falls, the spread (basis) becomes smaller. This makes basis trades less profitable, causing:

- Fewer ETF inflows

- More institutional selling

- Retail investors panic and sell too

- Bitcoin price drops further

This creates a negative feedback loop — causing even more selling pressure.

Hayes says many retail investors mistakenly think these institutions are losing faith in Bitcoin, but they’re not—they are simply exiting a trade strategy, not rejecting Bitcoin as an asset.