Monad Responds to Slow Token Sales on Coinbase as Fewer Investors Show Interest

Monad Token Sale Slows on Coinbase, Faces Risk of Falling Short

After a strong start, sales of Monad’s MON tokens on Coinbase have slowed, putting the public offering at risk of not selling out.

On the first day, buyers purchased about 48% of the 7.5 billion tokens. By Tuesday afternoon, the total subscription had only reached just under 64%, showing that demand on the second day is much lower than the initial surge.

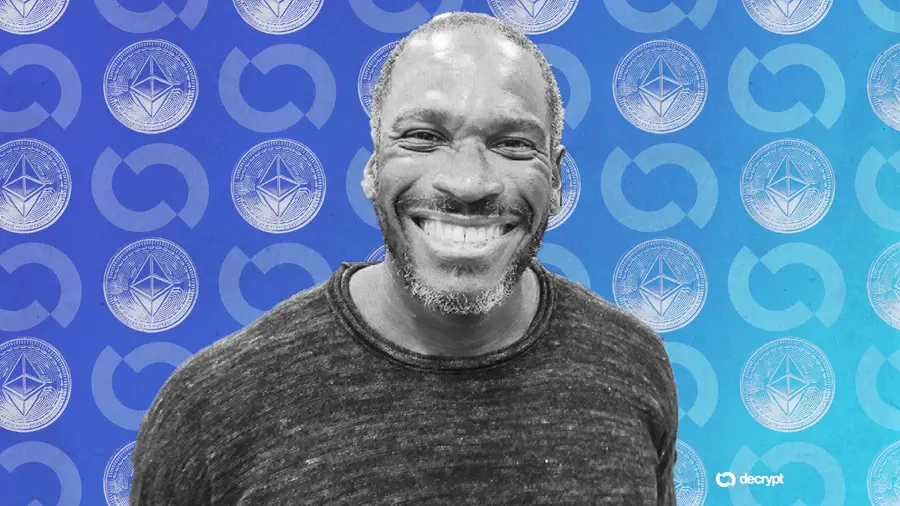

Monad co-founder Keone Hon addressed the slowdown on social media, explaining the sale’s approach. He said the goal of the token sale is “to achieve the broadest distribution” and that Coinbase’s allocation system is “democratic and transparent,” helping reach a wide audience.

The sale raised around $43 million within the first 30 minutes. Monad aims to raise $187 million in USDC, with minimum and maximum bids set at 100 USDC and 100,000 USDC, respectively.

Compared to other token sales, Monad’s offering is lagging. Last month, MegaETH’s sale raised $1.39 billion, far above its $50 million goal.

Some observers suggest that limiting the sale to U.S. traders may have hurt demand. Others think Monad’s token structure and past fundraising could have discouraged investors.

Hon also noted that buyers have 5.5 days to decide and are locked in once they commit, which encourages many to wait until the last moment.

If any tokens remain unsold by Saturday, they will be redirected to Monad’s Ecosystem Development fund.

Coinbase’s new token-sales platform, launched after its $375 million Echo acquisition, arrives at a time when U.S. regulations for ICOs are becoming more favorable. With softening SEC guidance and new market-structure bills in Congress, Coinbase sees a brighter future for compliant token launches in the U.S.